How IPO investments work on United Traders platform

Ksenia Rudenko

United Traders producer and video director

In this article, we will focus on the process of investing in IPO through our platform and use an example to show how it works.

Selecting companies

Selection criteria, comparison with competitors, Price-to-SalesThe IPO calendar features on average 150-200 offerings a year, but United Traders selects only some of them. We evaluate every company that files with the SEC: we look at the product, the size of its customer base and customer growth rate, market volume, revenue growth over the past years and other indicators.

One of the key indicators that can be used to evaluate the potential growth of stocks after IPO is the price-to-sales ratio (P/S). A low P/S ratio could indicate that the company is undervalued and its stock has good potential. The ratio can also be used to compare against the exchange-traded competitors’ indicators. For example, if the P/S ratio is ×10, while the competitors trade at a P/S of ×15 and ×20, there’s a high likelihood that the stocks have a good post-IPO growth outlook.

Posting investment idea to United Traders

Order submission, the minimum entry thresholdThe stocks that went through a rigorous selection process get posted to the United Traders platform. To participate in an IPO investment with United Traders, you need to apply within the specified period. Recently the processing time between the posting of an investment idea and application deadline has been 1 to 3 days. You can apply for investment for any amount starting from the cost of one share.

IPO

Collecting and distributing orders, share allotmentWe stop accepting orders 1-2 days before an offering. After you submit an order, it will show in your United Traders account. The number of applications for joining an IPO is constantly growing, resulting in diminishing share allotment. To join an investment, we recommend you submit your orders at least for $1,000.

For instance, if the share allotment of some IPO on United Traders was 10%, and you had previously applied for $10, 000, the amount accepted for this investment would be $1, 000. The rest of $9, 000 would be returned to your account and you could use it for trying next IPOs.

The allocation of shares among investors occurs on the IPO day. You will see the number of shares and the amount accepted as an investment in your personal account.

There are cases when a company files for IPO but cancels it at the last moment. It may occur if this company gets acquired by any company or if there is a change in the market situation. For instance, in February 2020 Procore filed an SEC Form S-1 but soon canceled its offering because of the changes on the market — the company postponed its IPO “till markets stabilize”.

Post-IPO

Lock-up and stock saleYour stocks are on hold until the lock-up period expires (usually after 3 months), meaning that investors can’t sell shares — the provision is applied to them by an exchange. As soon as the lock-up period ends, shares are sold automatically and the return will be credited to your account. You can withdraw this money or redirect them to other investments.

Early exit

Though you can’t sell shares during a lock-up period, our traders find ways to fix investors’ gains by using different financial instruments: forward contracts, options, short positions, etc. To an investor this means that he or she can close an investment, covering the cost of this financial instrument. Usually, you can exit by 10-15% less than the market price.

You can apply for an early exit in your account as soon as you see this option there (usually in a month after IPO), and we will execute it within a single business day.

Fees

We charge commissions on your participation in IPO investments:

Entry fee: 3,5% of the price at which you bought the stocks. Charged at the start of investment.

Exit fee: 0,5% of the price at which you sold the stocks. Charged at the closing of investment.

Profit fee: 20% of net income. Charged at the closing of investment, after the rest of the commissions are paid.

Examples of a negative and positive result

Releasing an investment idea and applications acceptance

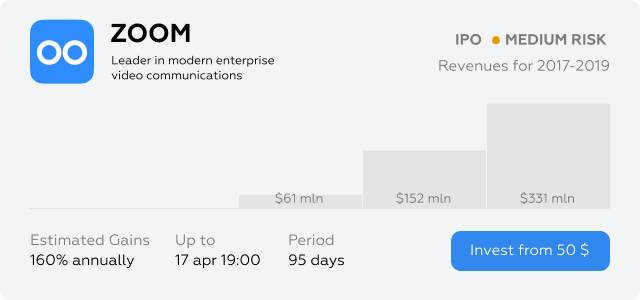

In April 2019 Zoom filed with the SEC and could be tracked in the IPO calendar. We evaluated the company and made a decision to participate in the investment, and the company was posted to the United Traders platform.

Zoom card on UT platform

You can join until April 17, 19:00 (UTC+3)

Expected start

After an order for IPO is processed, a user will see the investment order card with the current status and expected IPO date in his portfolio.

Order card in investor’s account

Scheduled IPO date: April 18

Trading starts: ≈11:30 a.m. New York Time Zone

Submitted amount: $800

Distribution of shares among investors

A few hours before trading starts, shares are distributed among investors, and only at this point does the share allotment and final price per share become known. If an allotment is less than 100%, the remaining funds in investor’s order will return to him.

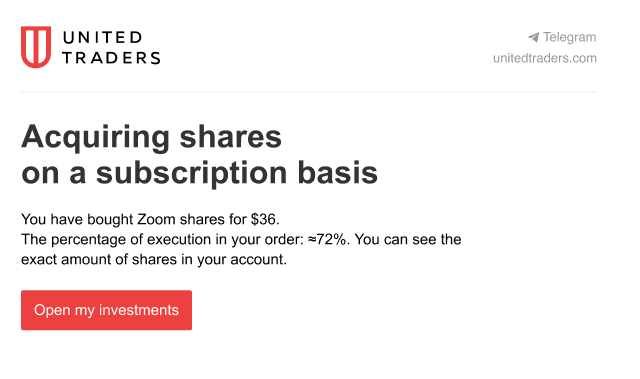

Example of an email we sent to investors

United Traders sends an email with the order details to every investor.

Allotment: ≈72%

Shares bought: 16

Price per share: $36

More information on the investment is available in the corresponding card in user’s personal account.

Investment amount: $576

Entry fee: 3% = $17.28

Debited from account: $593.28

Returned to account: $206.72

Trading start, share price change

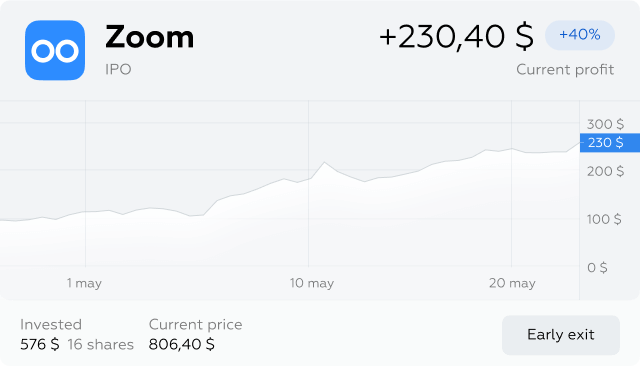

We wait until the lock-up period expires (≈3 months). A share price change will be shown in user’s account. A month after IPO a user can exit early, but the share price is growing, so it makes sense to wait for the scheduled completion of the investment.

Investment card as shown in investor’s United Traders account

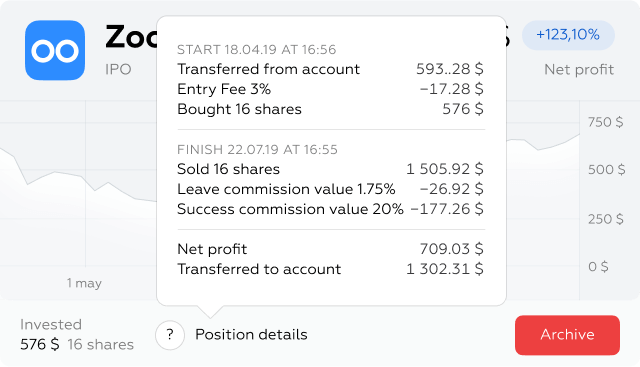

Automatic closing of investment

The invested money returns to your account, including the profit you’ve made, minus the commissions.

Lock-up period expires: July 22, 2019

Total shares price: $1 505.92

Exit fee: 1,75% = $26.92

Profit fee: 20% = $177.26

Credited to account: $1, 302.31

Profit: +123,1% = $709.03

A completed investment card as shown in investor’s account

Releasing an investment idea and applications acceptance

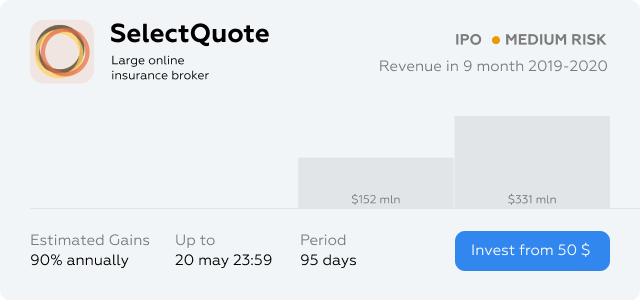

In May 2020 SelectQuote was put on the calendar of coming IPOs. We made a decision to join the investment, and the company was posted to the United Traders platform.

SelectQuote card on UT platform

You can join until May 20, 23:59 (UTC+3)

Expected start

After an order for IPO is processed, a user will see the IPO investment card with the current status and expected IPO date in his portfolio.

Order card in investor’s account

Scheduled IPO date: May 21

Trading starts: ≈10:30 a.m. New York Time Zone

Submitted amount: $500

Distribution of shares among investors

A few hours before trading starts, shares are distributed among investors, and only at this point does the share allotment and final price per share become known. If an allotment is less than 100%, the remaining funds in investor’s order will return to him.

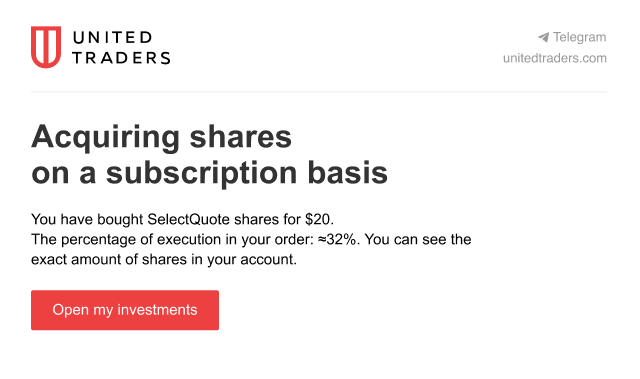

Example of an email we sent to investors

United Traders sends an email with the order details to every investor.

Allotment: ≈32%

Investment amount: $160

Price per share: $20

More information on the investment is available in the corresponding card in user’s personal account.

Shares bought: 8

Entry fee: 3% = $4.80

Debited from account: $164.80

Returned to account: $335.20

Trading start, share price change

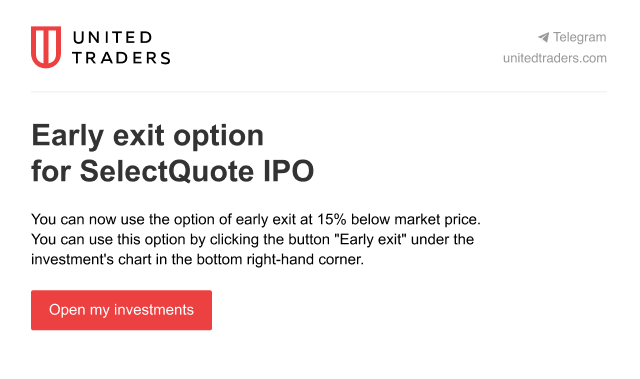

We wait until the lock-up period expires (≈3 months). During this time the shares are dropping. A month after IPO a user can exit early, but we keep the shares in hope that they will bounce back and start growing.

An email notification about available early exit option from investment

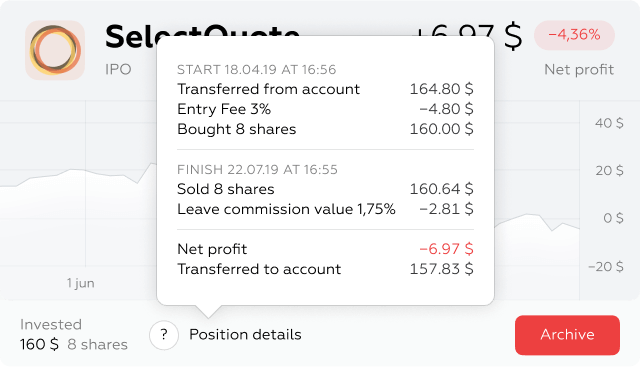

Automatic closing of investment

The invested money, minus only the exit fee, returns to your account.

Lock-up period expires: August 24, 2020

Total shares price: $160.64

Exit fee: 1,75% = $2.81

Credited to account: $157.83

Убыток: −4,36% = −6,97 $

A completed investment card as shown in investor’s account

On average per year, out of 8 profitable IPOs that United Traders selects for its platform, 2 IPOs prove unprofitable. You can view the Results of all IPOs on United Traders from 2015 to 2020 in a separate section.